The US Healthcare System in Comparative View (Testimony to the House Oversight and Reform Committee)

Read more here: https://www.commondreams.org/news/2022/03/29/watch-first-house-hearing-medicare-all-pandemic-struck

Read Prof Sachs’ written testimony here

Prof. Sachs’ testimony begins at 1:11:00.

Testimony of Professor Jeffrey D. Sachs

University Professor, Columbia University

House Oversight and Reform Committee

Hearing on “Examining Pathways to Universal Health Coverage”

March 29, 2022

The US healthcare system is dysfunctional compared with our peer nations (other high-income democracies). The US system is far more expensive (per person and as a share of GDP) than peer countries. The US health outcomes are far worse. Life expectancy in the US lags several years behind our peer nations. In the US, life expectancy stagnated between 2012 and 2019 at 78.8 years, whereas in the European Union, life expectancy rose from 80.2 years in 2012 to 81.3 years in 2019. (1)

The Commonwealth Fund has recently offered a detailed comparison of the healthcare systems of the US and 10 peer (comparison) countries: Australia, Canada, France, Germany, Netherlands, New Zealand, Norway, Sweden, Switzerland, and the United Kingdom. (2) I will also use these ten countries as the sample of peer countries in my testimony.

Some Congressmen claim that there are no true peer countries because the US is larger than the other countries and more diverse. For that reason, it is useful to compare the US healthcare system not only with individual countries, but with the European Union (EU) as a whole.(3) Both the US and EU are diverse, with richer and poorer regions. Yet the EU nations share basic healthcare principles that are far more effective than those of the US. As a result, the EU healthcare system overall is fairer, less expensive, and with comparable or superior outcomes to the US.

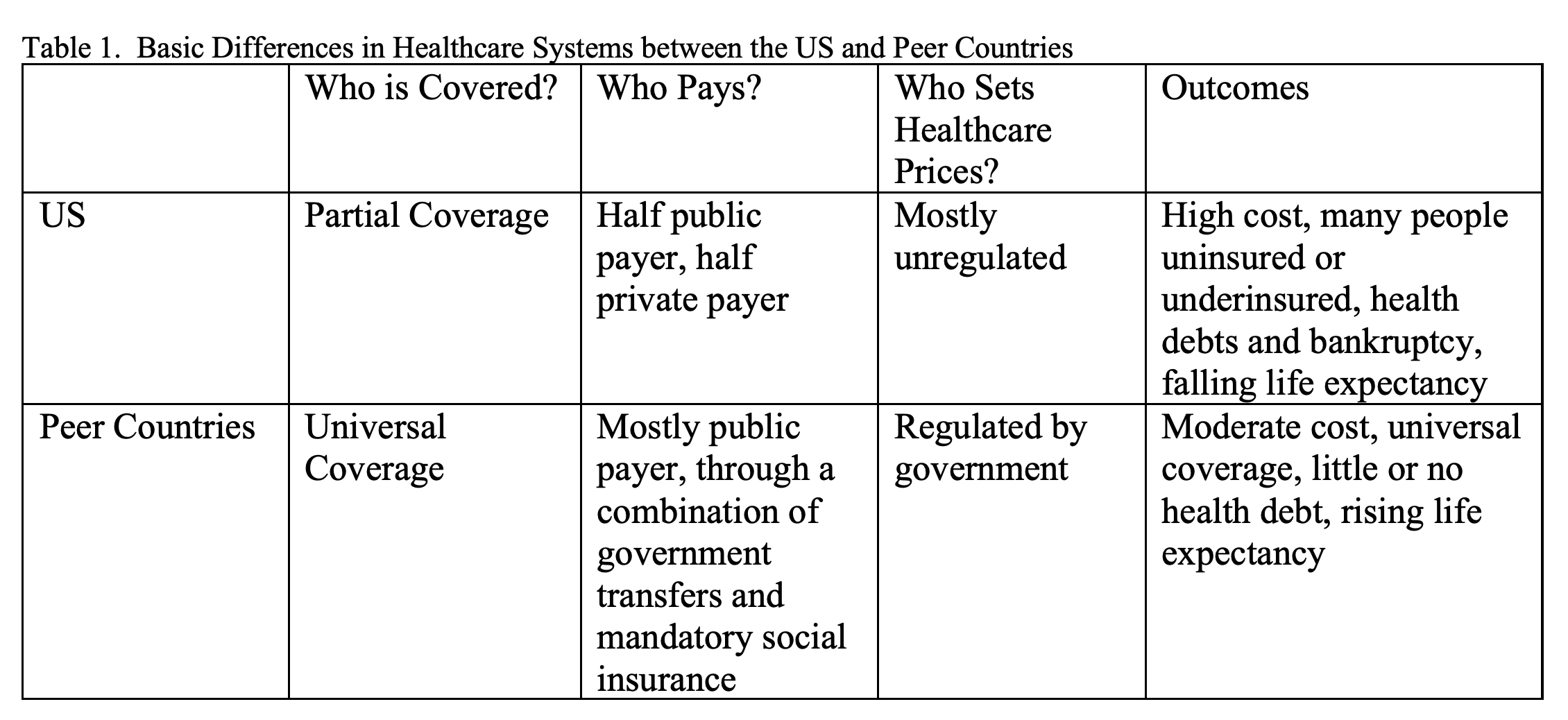

There are three basic questions about the design of a healthcare system:

(1) Who is covered?

(2) Who pays?

(3) Who sets the prices?

The basic difference of the US and the peer countries (and EU as a whole) is summarized in Table 1. These are statements of general principle, with variation among the individual countries.

The peer systems can be described as Universal, Public-Payer, and Price-Regulated. They are not systems of socialized medicine, with the exception of the UK National Health Service, which is state-run. In the other countries, healthcare providers are (mostly) non-governmental health professionals such as private doctors, private group practices, and not-for-profit hospitals. The difference between these peer countries and the US is that the peer healthcare workers are remunerated mostly by public funds, whereas in the US, public and private funding are each around half of the total.

Public funding in Europe takes two main forms. In the Nordic countries, the UK, and some others, funding comes out of general government revenues. In France, Germany, the Netherlands, and Switzerland, funding comes from compulsory social contributions, often paid to private, regulated insurers. In all of the peer countries, private health providers face government regulated prices aimed at keeping drug prices and other healthcare costs under control. The specific coverage of these regulated prices varies across countries.

The most important comparisons are shown in Figures 1 and 2 and Table 2, taken from the most recent Commonwealth Fund comparison report and Our World in Data. The US spends by far the most on healthcare of any of the 11 countries (Figure 1). As of 2019, health spending in the US was nearly 18% of GDP, compared with 10-12% of GDP in the peer countries. In dollars per capita, the US spending in 2019 was around $10,000 per capita, compared with roughly $4,000 - $7,000 in the peer countries. In 2020, the first year of the pandemic, US national health expenditures rose to nearly 20% of GDP, more than $12,000 per capita.

Figure 1. Health Care Spending as a Percentage of GDP, 1980–2019. Notes: Current expenditures on health. Based on System of Health Accounts methodology, with some differences between country methodologies. GDP refers to gross domestic product.

* 2019 data are provisional or estimated for Australia, Canada, and New Zealand.

Data: OECD Health Data, July 2021.

Source: Eric C. Schneider et al, Commonwealth Fund, “Mirror, Mirror 2021, Reflecting Poorly: Healthcare in the United States Compared to Other High-Income Countries,” August 2021.

Despite these far higher outlays, the US health outcomes are generally comparable or worse than in the peer countries. Life expectancy in the US was 78.9 years in the 2019, while in the peer countries, it was in most cases between 81 and 84 years (Figure 2). The Commonwealth Fund assesses the US to rank last (in 11th place of the 11 countries) in overall health system performance, with a last place in four of the five categories: access to care, administrative efficiency, equity, and healthcare outcomes (Table 2).

Figure 2. Life expectancy, 1990-2019. Source: Riley (2005), Clio Infra (2015), and UN Population Division (2019). Max Roser, Esteban Ortiz-Ospina and Hannah Ritchie (2013) - "Life Expectancy". Published online at OurWorldInData.org. Retrieved from: 'https://ourworldindata.org/life-expectancy'

Table 2. Health Care System Performance Rankings. Data: Commonwealth Fund analysis. Source: Eric C. Schneider et al, Commonwealth Fund, “Mirror, Mirror 2021, Reflecting Poorly: Healthcare in the United States Compared to Other High-Income Countries,” August 2021.

Why are healthcare costs sky-high in the US? Voluminous evidence shows that this is due mainly to very high costs of procedures, drugs, and hospital days in the US; in short, to the unregulated pricing of health services. (4) US healthcare providers have enormous market power in their respective catchment areas, with very few providers.(5) Pharmaceutical companies have market power due to patent protection. As a result, healthcare providers and pharmaceutical companies are able to set prices far above marginal production costs.

The drug companies are notorious for price gouging. An infamous recent example was Gilead’s pricing of Sofosbuvir, a drug that the company purchased from the inventor and then marketed at roughly 1000X times the marginal cost, thereby prolonging the US epidemic of Hepatitis C. The company got rich, while US military veterans suffering from Hepatitis C got liver failure. Such price gouging is defended in the name of “innovation,” but this is overly simplistic. Sofosbuvir was developed by academic researchers, and then purchased by Gilead.

Consider also Moderna’s lifesaving Covid-19 mRNA vaccine. The NIH funded the basic science of mRNA vaccines for more than a decade, much of which was in partnership with Moderna. Moderna (and BioNTech-Pfizer) walked away with the profits of the mRNA vaccines, while the US government has bought the vaccines at commercial prices.

The high prices of healthcare and pharmaceuticals translates into soaring profits and wealth of the healthcare industry. Figure 3 is from a Wall Street Journal report on CEO compensation of large pharmaceutical companies. Note that compensation runs in the tens of millions of dollars, simply staggering sums. Figure 4 reports the salaries of hospital administrators of major not-for-profit hospitals. The salaries are astounding: several million dollars per year.

Figure 3. Highest-Paid Pharmaceutical CEOs. Source: Wall Street Journal, 2019. Note: Industry groups defined by Standard & Poor's. Shareholder return reflects 1-year total shareholder return through the month-end closest to each company's fiscal-year end.

Data from: MyLogIQ LLC (pay); Institutional Shareholder Services (performance). [Accessed March 29, 2022:https://graphics.wsj.com/table/CEOPAY_slice_Pharma_0606]

Figure 4. Top 10 Non-Profit Hospitals (2016-2017). Andrzejewski, Adam et al. “Top 82 US Non-Profit Hospitals: Quantifying Government Payments and Financial Assets.” Open The Books Oversight Report. June 2019. https://www.openthebooks.com/top-82-us-non-profit-hospitals-quantifying-government-payments-and-financial- assets--open-the-books-oversight-report/

Figure 5 shows in simple terms that the high-profits also show up in high stock-market returns. The S&P 500 health sector enjoyed annualized returns of 13% over the past 10 years, the third highest sector, lagging only behind IT and discretionary consumer products.

Figure 5. Annualized Equity Returns by Sector (S&P 500). Source: S&P Dow Jones Indices. “S&P Sectors: US Equity.” Last updated February 28, 2022. [Accessed 20 March 2022: https://www.spglobal.com/spdji/en/index- family/equity/us-equity/sp-sectors/#overview]

Another source of high healthcare prices in the US are extremely high administrative costs. As shown in Figure 6, administrative costs among private health insurers averages around 13% of total outlays, compared with around 3% for Medicare. According to the OECD estimates in Figure 7, the US spends around 1.4 percent of GDP, roughly $300 billion a year on administrative costs, while our peer countries spend less than half of that share of GDP.

Figure 6. Uses of Premium Revenues in Fully Insured Markets, 2010 to 2012. Data from: Congressional Budget Office, using 2010 filings of the Supplemental Health Care Exhibit (National Association of Insurance Commissioners) and 2011 and 2012 filings of the Medical Loss Ratio Annual Reporting Form (Centers for Medicare & Medicaid Services). Source: Burns A, Ellis P, et al. “Private Health Insurance Premiums and Federal Policy,” Congress of the United States Congressional Budget Office Report, February 2016. www.cbo.gov/ publication/51130

Figure 7. Governance and Administrative Costs as Percent of GDP. Source: OECD. https://data.oecd.org/health.htm

Shifting to a Universal, Public-Payer, and Price-Regulated system, as in our peer countries, would save a fortune for Americans. Congressional opponents of public-payer system claim that such a move would be “unaffordable,” and often cite a 2018 study by Charles Blahous for the the libertarian-leaning Mercatus Center at George Mason University to that effect.(6) The Mercatus Foundation projected that a move to Medicare-for-All (M4A) would add an extra $32.6 trillion over 10 years (2022-2031) to the federal budget compared with the current baseline. Yet the Mercatus study also estimated that non-federal outlays, mainly private outlays, would decline by $34.7 trillion over 10-years, for a net saving in overall health outlays equal to $2.1 trillion. This is summarized in Table 3 (data are in $ trillions). In other words, households would save more by eliminating out-of-pocket payments and private health insurance premia than the government would raise in revenues to fund the public system. The public system would be cheaper for the nation, not more expensive.

Table 3. Net Cost Savings Of $2 Trillion in Mercatus Foundation Study. Source: Blahous (2018). (Author’s calculations)

There are two more key facts to drive home this crucial point. First, the increased government revenues would presumably be raised through progressive taxation, i.e., from higher-income taxpayers. The working-class households would therefore save twice, first in the reduction of overall health outlays, and second in the shift of financing towards higher-income households.

Second, and at least as important, the overall cost saving should be much more than $2 trillion over ten years (though $2 trillion in saving over ten years is nothing to ignore). The shift to M4A should include price regulation, as in every peer country. The US now spends around 20% of GDP on health outlays, while our peer countries spend 10-12% of GDP because of lower unit costs. The US healthcare costs under M4A might not fall all the way from 20% of GDP to 12% of GDP, but it is reasonable to think that the US could get health costs down to 15% of GDP, higher than in the peer countries, but far lower than today. The savings would be then be around 5% of GDP, more than $1.1 trillion at the projected 2022 GDP of $23.7 trillion.

These are simply illustrative numbers. The actual saving would be determined by the detailed operation of the new system. The most important determinant of saving would be the pricing regulations introduced into M4A.

Note that the single-state experiments in public financing, such as in Vermont, tell us very little about what would happen in a federal M4A system. A state like Vermont is a “price taker” of the exorbitant US healthcare costs. Vermont by itself can’t lower these costs through regulation, because healthcare providers and pharmaceutical companies would shift operations out of Vermont. Yet in a federal system, the health providers and drug companies could not shift operations outside of the US, since those overseas markets are already tightly regulated.

It behooves us to ask why the US sticks with such a miserably broken and unfair system, one that is literally killing and bankrupting Americans. The answer, alas, is the political power of the healthcare lobby. As shown in Figure 8, using data from OpenSecrets.Org, the healthcare sector is the number 1 economic sector in lobbying outlays, having spent an extraordinary $10 billion on lobbying outlays during the period 1998-2021. The industry is also an extraordinary campaign funder. In the 2019-2020 federal election cycle, health-sector PACs gave $49.2 million in campaign spending, divided roughly equally between Democrats and Republicans.(7)

Figure 8. Lobbying by Industry ($billion), 1998-2021. Based on data released by the Federal Election Commission on March 22, 2021. Source: OpenSecrets.org [Accessed March 29, 2022: https://www.opensecrets.org/political-action-committees-pacs/industry-detail/H/2020]

(1) See https://www.cdc.gov/nchs/data/hestat/life-expectancy/life-expectancy-2018.htm#Table1 and https://ec.europa.eu/eurostat/databrowser/view/demo_mlexpec/default/table?lang=en for 2019. See

(2) Commonwealth Fund, “Mirror, Mirror 2021, Reflecting Poorly: Healthcare in the United States Compared to Other High-Income Countries,” August 2021

(3) The US and the EU are of roughly comparable size. The US has a population of 332 million; the EU, 447 million. The US GDP in 2021 was $23 trillion; in the EU, $17 trillion.

(4) See Barber SL, Lorenzoni L, and Ong P. “Price setting and price regulation in health care: lessons for advancing Universal Health Coverage,” World Health Organization and the Organisation for Economic Co-operation and Development, 2019.

(5) Lin, L and Mrkaic M. “U.S. Healthcare: A Story of Rising Market Power, Barriers to Entry, and Supply Constraints,” International Monetary Fund, 2021, 55 p. https://doi.org/10.5089/9781513585451.001

(6) Blahous, Charles, “The Costs of a National Single Health-Payer System,” Mercatus Working Paper, July 2018

(7) See https://www.opensecrets.org/political-action-committees-pacs/industry-detail/H/2020